New “buy now, pay later” payment options offered from companies like Klarna, Affirm, and Afterpay have been popping up everywhere. If you have done any online shopping with popular retailers like Target, Sephora, or even Etsy, you’ve likely noticed these options when you hit the checkout page.

With the click of a button, you can set up installments on just about any online purchase. Seems pretty cool, right? I mean, you can order an entirely new wardrobe – and not have to pay for it all upfront. They don’t charge you interest. And the best part? They still send you everything you ordered, even before you finish the payment plan.

With online shopping growing exponentially in recent years, these “buy now, pay later” have exploded. Have you been tempted to do it? Before you hit that button, let’s talk about what these payment options really are, what they may do to your credit score, and whether or not you should utilize them.

What Are BNPL Loans?

These payment options aren’t just payments. They are actually short-term loans from financial service providers. You can call them “buy now, pay later” (BNPL) loans, or point-of-sale (POS) loans. Like other loans and even traditional credit cards, they offer the ability to – you guessed it – purchase items and finish paying for them later.

Unlike traditional credit cards and other loans, though, some BNPL loans are offered with the promise of 0% interest and no penalties for late payments.

I have seen them offered on a variety of websites at this point, making it possible to buy just about anything with them. In fact, there aren’t really limitations on what kinds of purchases qualify, only limitations on the amount you can finance. You could buy patio furniture and a box of cereal, for all they care.

To add to the convenience, most major retailers will have that “buy now, pay later” button sitting on the checkout page. That’s because the biggest BNPL providers – Klarna, Afterpay, Affirm, and even PayPal – have partnered with major retailers.

However, some of these providers also have their own apps and browser plugins, enabling you to use them just about anywhere you please. And by anywhere, I mean the apps will even let you use these for in-store purchases.

BNPL loans divide your total purchase cost into equal payments. The first payment is due at checkout, and the rest are done in a series of installments over a fixed period of time. Payments are usually due bi-weekly or monthly. And of course, you get all the goods right upfront before you even make your second installment.

It is easy to see the appeal!

But again, it’s important to understand that these are actually loans. And that means that it’s incredibly important to understand what you’re getting into.

Are They Really Interest-Free?

While many of the four-payment options you see offered on a checkout page are offering loans at 0% interest, always, always double-check that you know what you’re getting into. Not all BNPL loans are the same.

Those basic BNPL options that divide your balance into four equal payments don’t usually charge interest. Other plans may charge an annual percentage rate, or have late fees associated with them. Again, you need to read carefully before jumping in. BNPL loans can be different depending on the provider.

Can a BNPL Loan Raise or Lower Your Credit Score?

Traditional loans can definitely affect your credit score, so you may be wondering about these. Do BNPL loans have any effect on your credit score? The answer is… maybe.

As of right now, these kinds of loans typically aren’t reported to credit bureaus. That means it won’t help or hurt your score. If you are hoping to build credit or boost a low score, a BNPL loan won’t give you any benefit. On the other hand, though, late payments generally won’t hurt your credit unless your account gets sent to collections.

For those that do report to credit bureaus, they could potentially lower your credit score – even if you’re in good standing. That’s because part of your credit history has to do with the average age of your accounts. Each BNPL loan is counted as a separate account on your report. The more BNPL loans you pay off, the lower your average age gets.

What about when you apply for the loan? This one is also a maybe.

Usually, you have to fill out a short application from the checkout screen. They ask for basic info, like your name, address, and date of birth. Some ask for your social security number, and you also have to provide a payment method. From here, the BNPL provider may perform a soft credit check. These soft checks don’t affect your credit score.

Though uncommon, some of these providers may do a hard credit check. If you’ve ever had one of these done, like when applying for a credit card, you know that it will temporarily lower your credit score. Definitely pay attention to the application, because it will tell you if you’re about to submit to a hard check.

It is worth noting that all three major credit bureaus do have plans to add data about BNPL loans to credit reports. We just aren’t there yet. While Equifax, Experian, and TransUnion are all making plans on how to handle the growing market of BNPL loans, they are currently different.

Should You Use BNPL Loans for Purchases?

Okay, now for the important question: should you use “buy now, pay later” options at checkout?

I wish I could give a definitive, blanket answer for everyone. Unfortunately, the decision ultimately comes down to your personal finances and the BNPL plan itself.

As a general rule, I only recommend using these kinds of loans for necessary expenses. We’re talking about a new computer for school or a mattress for your new apartment. For more frivolous purchases, like that new summer wardrobe, it is best to do it the old school way: by budgeting and saving up.

That’s because, no matter how convenient that “buy now, pay later” button on the checkout page may be, it is still a loan. You’re still taking on debt when you click that button. It is rarely ever a good idea to go into debt for nonessential purchases.

If you are currently struggling to pay your existing bills, stay away from BNPL loans.

BNPL loans are also banking on how convenient they are. They seem simple and low-cost, so why not just pay off those sneakers later? But eventually, all those little purchases do add up. It is very easy to overspend this way. Not only might you find yourself buried in debt, but you might also wind up with too many separate payments to keep on top of. The next thing you know, you are missing payments and getting sent to collections – and that will affect your credit score.

If you are hoping to build credit, other alternatives will be better options for you. At the moment, BNPL loans aren’t going to help you here. If you are able to qualify for a traditional credit card, a retail store card, or even a secured credit card, these will help you boost your credit. Some may also offer rewards that BNPL loans do not.

BNPL Loan Providers

There are plenty of providers offering BNPL loans out there. Some credit card companies, like American Express and Chase, have started their own similar financing arrangements. PayPal has also introduced its own BNPL loan program.

Here are some of the big ones that you are likely to see:

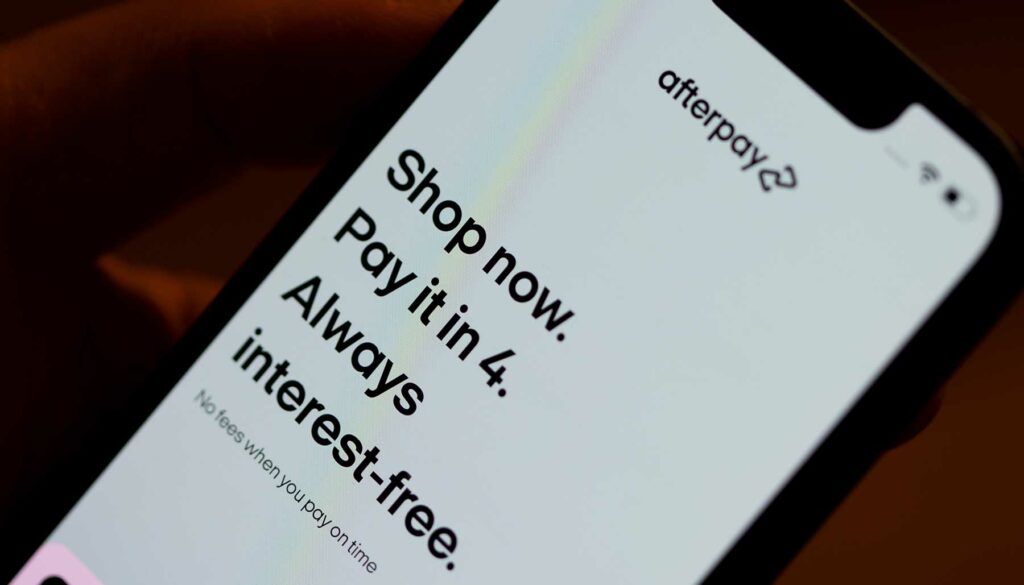

- Afterpay – One of the largest BNPL providers, Afterpay is the one I see most often from major retailers. It’s a straightforward pay-in-four plan with no interest, but Afterpay does charge late fees.

- Klarna – This one offers a pay-in-four plan with no interest, but there are late fees. You can set it up to automatically deduct installments from your payment method of choice.

- Affirm – Unlike other BNPL providers, Affirm interest rates vary by retailer. Your rate will differ based on which website you’re shopping on. There are no fees for late payments, though.

- PayPal – Already accepted just about everywhere for online payments, you can now use PayPal to set up pay-in-four plans with no interest or late fees. Payments will be deducted from your payment method attached to your PayPal account.

- Sezzle – This BNPL provider does not charge interest on pay-in-four plans, and there aren’t late fees. However, missing a payment will cause Sezzle to deactivate your account. If you ever decide to use it again, you’ll have to pay a reactivation fee.

- Zip – You won’t find a checkout button for this one. To use Zip, you have to download the mobile app. From there, you can use it online or in-store. Zip, formerly Quadpay, does not charge interest, but it does charge a convenience fee per installment and there are late fees.